Unlocking the Secrets of 1031 Exchanges for Vacation Properties

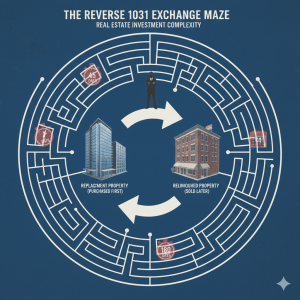

Navigating the financial landscape of vacation properties can become a labyrinth of tax laws and regulations, especially when leveraging the 1031 exchange. This oft-overlooked mechanism can significantly enhance the value of investment properties, lowering or deferring taxes when buying and selling real estate. Let’s delve into how you can master 1031 exchanges for your vacation property transactions.

What is a 1031 Exchange?

At its core, a 1031 exchange, derived from Section 1031 of the U.S. Internal Revenue Code, allows you to defer paying capital gains taxes when you exchange one investment property for another of “like-kind.” Initially aimed at promoting reinvestment in real estate, this tax deferral can be a golden opportunity for vacation property investors when executed correctly.

**Qualification as Relinquished Property**

Not just any vacation property can be utilized for a 1031 exchange. Certain criteria must be met for a property to qualify as ‘relinquished.’ For a vacation home to fit this category:

1. **Time Ownership**: It should have been owned by the investor for a minimum of 24 months before the exchange.

2. **Rental Activity**: The property needs to be rented at fair market value for more than 14 days across two 12-month periods.

3. **Personal Use Limits**: Personal use by the owner should not surpass 14 days or 10% of the rental days each year.

Meeting these criteria ensures the property is primarily seen as an investment rather than a personal retreat, maintaining its standing as suitable for a 1031 exchange.

**Qualification as Replacement Property**

Once you’ve successfully swapped an old property, ensuring the new property qualifies is equally important. The rules mirror those of relinquished property requirements—rented and minimally used for personal purposes—to provide continuity in exchange integrity.

**Critical Updates to Keep in Mind**

1. **Increased Reporting Requirements**: Beginning in 2025, the IRS mandates enhanced reporting to promote transparency. This includes detailed appraisals and transaction timelines documented via Form 8824. Ensuring accuracy in reporting is crucial to avoid penalties and preserve tax benefits.

2. **Expanded Asset Classes**: The IRS has broadened the pool of “like-kind” real estate to now include innovative projects such as renewable energy sites and mixed-use developments, opening new vistas for strategic property exchange.

3. **Cap on Deferral**: Introducing a $5 million cap on capital gain deferral changes the game, with any gains beyond this amount becoming immediately taxable. This will require strategic planning and careful consideration of property values.

**Strategizing for Success**

Understanding and adhering to these guidelines can set the stage for maximizing financial gains while minimizing taxes. The key lies in diligent planning, seeking out viable properties, and managing rental schedules judiciously to align with IRS expectations.

No overnight millionaires are made through 1031 exchanges, but with patience and proper management, your investment in vacation properties can take you from seasonal visitor to strategic investor. Find your dream investments, list them under stringent compliance, and let the magic of tax deferral work to your advantage.

For anyone invested in or considering vacation properties, the ability to conduct these exchanges not only enhances portfolio value but also secures a distinct tax advantage, making it a strategy worth exploring. Keep these regulations close, consult with a tax professional, and embark on your journey with confidence.